‘All About’ the Ligue 1 UberEats TV rights

A lot has happened since the attribution of the Ligue 1 UberEats TV rights to Mediapro. And the least we can say is that the situation has been quite chaotic before the championship returned a month ago.

As a brief reminder, “the genesis of the current crisis goes back to 2018 when a record deal with Mediapro to broadcast games was announced” Bobby MacMahon wrote in Forbes. This announcement was supposed to be a game changer for French clubs and it should have catapulted Ligue 1 into a position alongside the likes of the Bundesliga, Serie A and La Liga..

We won’t tell the story again as you probably know how it ended. But one thing is certain: as French people and football lovers, we’ve been lucky enough to have Canal + rescuing us, no matter what the conditions, with the broadcast rights of the 2020/2021 season.

Forbes: How Ligue 1’s Dream TV Deal Has Turned Into A Financial Nightmare

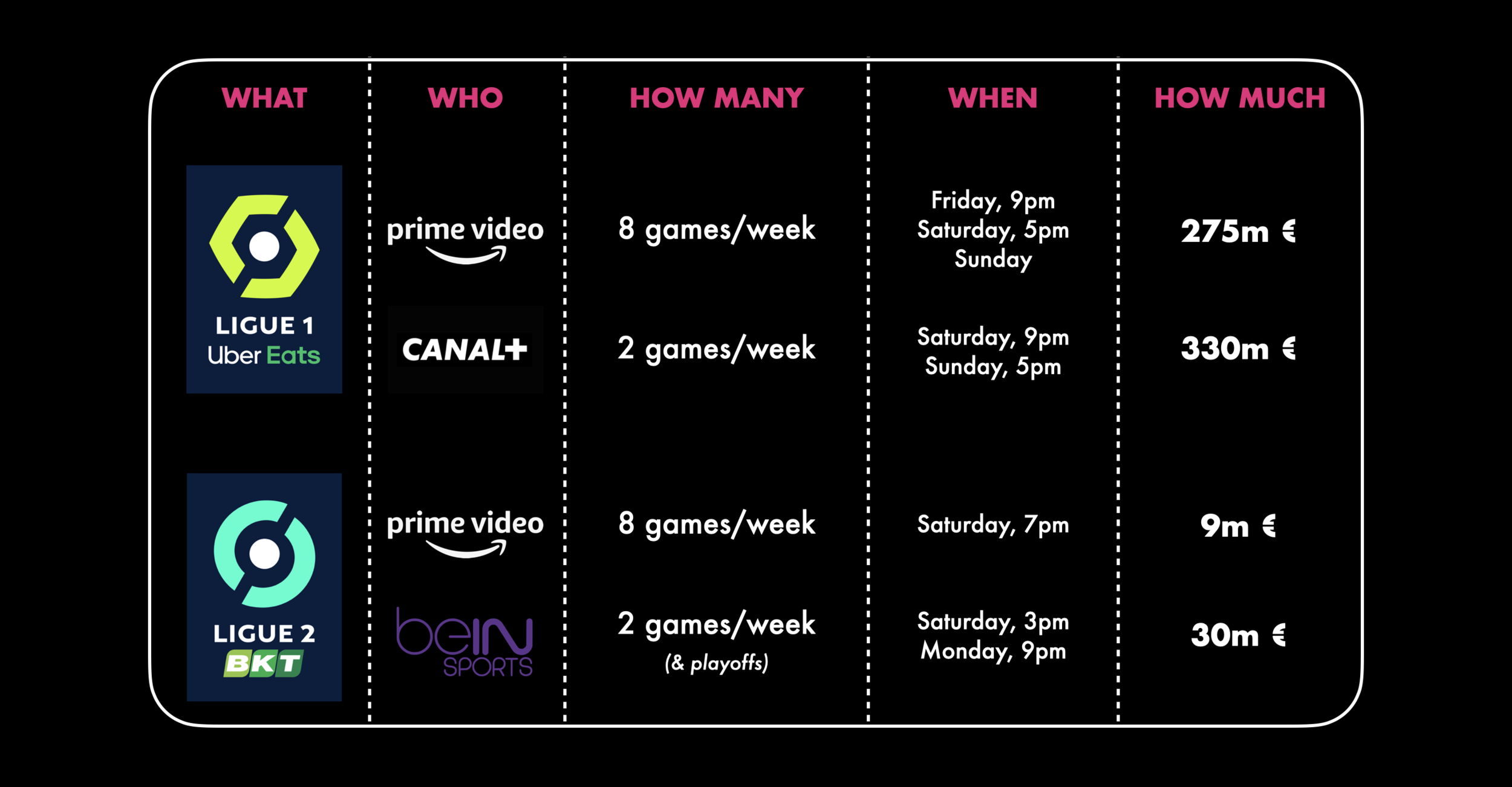

What about the rights for the 3 other seasons? The LFP launched a new consultation back in January 2020 that went unsuccessful because the offers received (Amazon, Discovery, DAZN) were under the reserve price. But five months later, the league decided to finally award the Amazon group the rights to the bundles of the two Ligue 1 Uber Eats and Ligue 2 BKT consultations. These bundles notably include 304 Ligue 1 UberEats games with the ten best games, as well as 304 Ligue 2 BKT games. Canal + would still have its Ligue 1 UberEats 76 games per season.

LFP Press release: https://www.lfp.fr/Articles/COMMUNIQU%C3%89S/2021/06/11/communique-de-la-lfp

A risky decision?

From the league standpoint, obviously not. “This decision, taken unanimously by the board of directors minus one abstention, will allow French football to benefit from the arrival of a new major player, Amazon », French league President Vincent Labrune said. And they hope that it will enhance the development of French professional soccer and the attractiveness of its competitions.

On its side, Amazon strikes a blow! Alex Green, managing director of Prime Video Sport Europe, said: “Ligue 1 is the country’s most watched domestic football competition and we’re incredibly happy to bring every club and the most thrilling matches to Prime Video each week for the next three seasons.”

LFP’s long standing partner Canal + did not see it the same way, having specified it “regretted the LFP’s decision to choose Amazon’s proposal to the detriment of its historic partners Canal+ and BeIn Sports”. Since then, the two broadcasters as well as the french football league have been asserting their rights, leading to legal proceedings and other financial complications. A few weeks ago on August the 5th, the French court ordered Canal + to respect its contract to show two Ligue 1 matches per week. Canal + said they will appeal the decision so the end of this story is not yet in sight!

SportsPro Media: https://www.sportspromedia.com/news/ligue-1-tv-rights-amazon-canal-lfp

Digital TV Europe: BeIN Sports takes legal action against football partner Canal+

APN News: Canal+ ordered to show French league games in TV rights feud

How much are we talking about?

One media industry executive close to the deal said Amazon had agreed to pay about 275 millions a year to screen roughly 80 percent of French top-flight matches. But the deal has infuriated Vivendi executives because Canal Plus had previously agreed to pay €330m for the remaining 20 per cent, or just three games a week. Under the deals accepted by the LFP, BeIN, which bid for 80 percent of Ligue 1 matches and all Ligue 2 games, would have to do with two Ligue 2 matches per round at a cost of €30 million a season. Amazon will pay €9 million, plus production costs, estimated at €25 million, for the rest.

In total and until 2024, the US giant tech company will invest 777€ million euros, or $920 million dollars, for these rights. And if we add the production costs associated with these programs, the investment will probably exceed one billion dollars.

Financial Times: https://www.ft.com/content/734fd323-fd30-466e-b95d-5c5239e12b73

What about the fans?

On July 14th, Amazon unveiled its pricing plan for people wishing to watch French top-flight Ligue 1 football matches. The fee has been set up at €12.99 a month on top of the 5.99€ Amazon Prime cost. For non prime subscribers, it will then be 18.98€ .

"We think it is a fair price. It will make watching soccer accessible both in terms of costs and usage", Alex Green, Managing Director of Prime Video Sport Europe, told Reuters.

Is it fair for them? Hard to answer. At first glance, the price is much more reasonable than what it used to be during the short Mediapro era where you had to pay 29,99€ for Telefoot. But on the flip side, one can also understand the frustration of having to pay again for a new service, in addition to Prime subscription, even if it is admittedly very low. Trusting a newcomer can sometimes be a tricky thing. It is called “the fear of change”. Indeed, we have our own habits, our favorite programs and we are sure about the quality, or at least we know what to expect. With a new actor it is much more complicated. We can’t be sure of anything, from technical standpoints such as captation and broadcasting, to the editorial lines and its relevance. As said by Cédric Roussel, an MP from Emmanuel Macron’s ruling party: “I’d rather that risk be taken with Amazon rather than with a new entrant who doesn’t have a solid financial backbone.”

If we take a step back, paying almost 19€ and having the French Ligue 1 UberEats plus all the other Amazon services (one day delivery, Prime Video with series and films, Prime Music, a free Amazon Prime Twitch subscription once per month, etc.) can be of a real interest and profitable faster than expected!

A record deal for Amazon in Europe

Amazon is investing more and more in sports, that’s a fact. But with this $920 million dollars deal, they are definitely getting into the courtyard of the major actors in the European sports media landscape. As a reminder, the Seattle based company started investing in sports video rights back in 2018 with the US Open and the ATP Tour in UK and Ireland. During the same year, they acquired 20 Premier League games to be broadcasted on Prime Video from 2019 to 2022 (the deal was rolled over until 2025.) as well as some UEFA Champions League rights in Germany and Italy. But the comparison can’t be done with the 304 Ligue 1 UberEats games they will broadcast in France. Indeed, it is the very first time the company is purchasing almost all the broadcasting rights of a football league.

The challenge is audacious and the investment consequent because France is not such an important market for Amazon in Europe (United Kingdom and Germany are priorities). The number of subscribers varies between 7 and 10 millions and obviously they are not all using Prime Video. But their recent test in the UK with the rights for 20 Premier League games has shown a record in subscriptions with millions of fans to watch their debut.

Amazon’s moves into Sports seem unstoppable

Amazon has always been one of the best placed companies since sporting events have started being live-streamed on on-demand video services. The E-commerce giant has two major trends’ assets in its pocket:

Consumers continue to migrate to digital platforms: “data from market research firm Kantar Media showed over 1.3 million subscribers signed up for streaming services like Prime Video, Netflix and Disney Plus in the final quarter of last year, with Amazon securing 49 per cent of the market share and Netflix, in second, taking 17 per cent.” The Straits Times reported

Frustration of European sports fans: “Buffeted between high-priced subscription plans and complex regional restrictions, many are adopting a wait-and-see approach to Amazon's arrival which may offer simpler and cheaper access to elite sports.” Politico.

The Straits Times also highlighted that “Unlike TV broadcasters, Amazon does not buy sports rights to push advertising and inflexible subscriptions. Via Prime Video, its aim is to attract new subscribers and retain customers in the hope they will shop on Amazon and use Prime delivery. Data firm Ovum noted that Prime's global subscribers spend twice as much on Amazon compared to non-subscribers”

The Straits Times: Amazon primed for live telecast attack

Marie Donoghue, Amazon’s vice president of global sports video at Amazon, herself acknowledges in a SportsPro media interview that “we’re not a 24/7 sports service, we’re a much broader entertainment service, we’re global, so we look at things a little bit different. We literally start with the customer and work backward. We’re always looking to see what the customer is enjoying and how we can better serve the customer, and there’s no better example of someone who engages with it more and stays more when they use it.”

She continues: “We use sports to drive engagement and focus to our overall Prime Video offering, so fans don’t just come in and watch the Premier League. We know they come in, they get exposed to broader Prime Video offerings, whether it be entertainment, or documentaries, or other things. And of course they also get exposed to the other Prime membership benefits.”

Clearly, Amazon has every tool in its arsenal to be a prominent and popular player in sports media for the future. But as one of the biggest companies in the world whose core business is far from being solely within the sports industry, every time it “increases its presence in a related field, it sends back the image of a machine that needs to be stopped, but it’s more of a political issue than a competition one. It is difficult to say that the development of Amazon Prime Video with sports and TV shows is anti-competitive in itself” said François Godard, senior media and telecoms analyst at Enders Analysis for Politico. In a long term vision, Amazon’s entry into the sports market could allow the tech giant to dictate the terms with leagues and consumers by increasing the prices, for example. “The leagues won’t have much room to maneuver if they get together with these kinds of partners. They will no longer be the ones to define the law of the market,” warned Grégoire Polad, who represents TV channels in Brussels.

Politico: Why Amazon’s move into European sports is unstoppable